Enabling Billing Markets

Before you can order services in a region, you need to enable a billing market.

We recommend that you enable multiple markets to cover your business needs. Each billing market will receive its own standalone invoice for that billing entity.

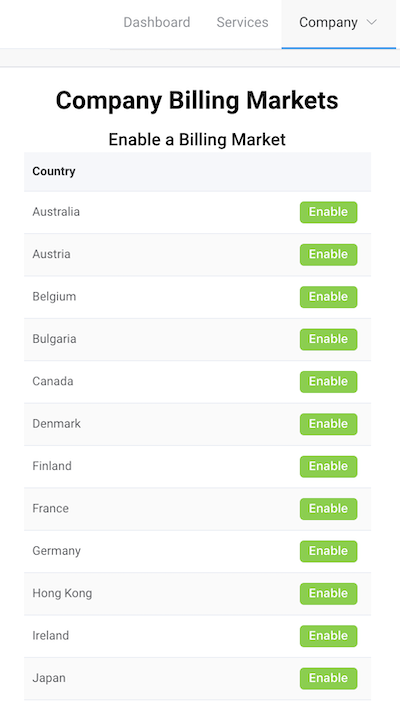

To enable a billing market

- Visit the Megaport Portal and log in.

- Choose Company > Company Profile.

-

Click View Company Markets.

If the Company Profile page isn’t visible, choose Company > Billing Markets.

-

Click Enable next to your preferred billing market(s).

Important

Before choosing a currency for your billing market, see Credit Card Payments to view the markets and currencies where credit card payments are currently accepted.

-

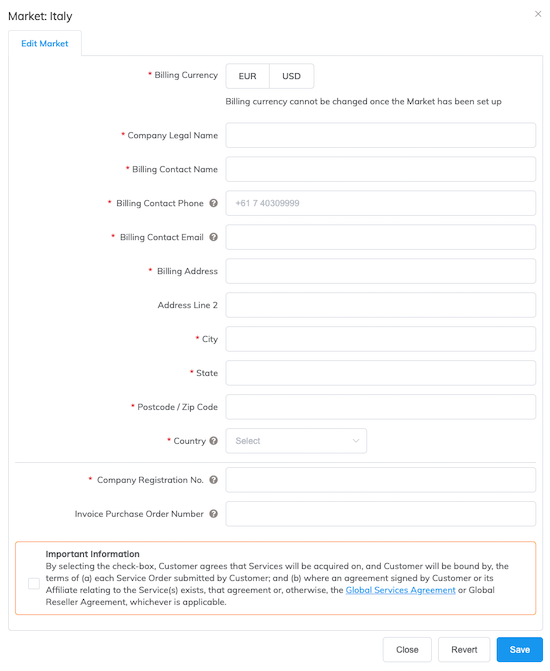

Complete all fields for the chosen billing market.

-

Billing Currency – The billing currency for this market.

Note that once you have chosen a currency for the billing market, it cannot be changed. See the Accepted Currencies table below for more information. -

Company Legal Name – The legal registered company name that appears in your profile.

-

Billing Contact Details – The name, phone, email address, physical address, and country for the billing contact. Use commas to separate multiple email addresses. For the Billing Address, enter the business location where the key decision makers who procure and provision Megaport services are based. The Billing Contact will be emailed an invoice on a monthly basis.

For tax calculation, Megaport uses the country specified in the Billing Address linked to the billing market. When you enable a market in the UK, Australia, or Singapore, you might be required to provide additional information needed to calculate an accurate tax rate. For example:

- United Kingdom – Answer whether you have registered for the value added tax (VAT). Registered users must provide their VAT registration number. If yes, confirm whether you have personnel in the UK who use Megaport services.

- Australia or Singapore – Answer whether the legal entity or branch that uses Megaport services is registered for the goods and services tax (GST). Registered users must provide their GST registration number.

-

Company Registration No. – The tax or VAT registration number as required per region.

Note

Company registration number is optional for the Mexico market, but is mandatory for all other markets.

-

Mexico Market Only - These fields are mandatory Mexico TAX Registration details for the CFDI (Electronic billing schema defined by the Mexican federal tax code).

-

Company Type – The legal tax ID type of the taxpayer (company (Legal entity), individual (Legal person), or foreign company). A company or individual is the taxpayer registered with the Mexico Federal Taxpayer Registry. A foreign company is a business or individual not registered with the Mexican TAX Administration Service (SAT).

-

Tax Regime – The Fiscal Regime code registered with the Mexican TAX Administration Service (SAT).

-

Tax Purpose – Relates to the use of the electronic tax invoice (CFDI) that will be issued to the taxpayer receiving the invoice. Use this field to record the economic activity on the electronic invoice that will be reported to the Mexican TAX Administration Service (SAT).

-

RFC Number – The Federal Taxpayer Registry number as issued by the Mexican Tax Administration Service (SAT). An RFC number is assigned to each taxpayer (Legal entity or person) that carries out economic activity in Mexico.

-

-

USA Market Only - Federal USF Traffic Certification – As required by the Federal Communications Commission (FCC), confirmation is needed here on the nature of the traffic where you purchase Megaport data transmission products between two points in the same state. For further context, the Federal Universal Service Fund (USF) is a charge levied by the FCC on interstate telecommunications services and this certification is needed to ensure we apply Federal USF charges appropriately on your invoices.

Complete the Federal USF Interstate Traffic Certification check box according to the following rules:- Select the check box to certify that more than 10% of traffic is interstate in nature in relation to all data transmission products purchased from Megaport - and therefore subject to Federal USF charges.

- Leave the check box clear to certify that 10% or less of traffic is interstate in nature in relation to all data transmission products purchased from Megaport - and NOT subject to Federal USF charges.

You acknowledge that Megaport’s determination of jurisdiction of the services and assessment of Federal USF will be based upon the information provided by you in this certification. If Megaport determines that the jurisdiction has been established based upon false, inaccurate or erroneous information, Megaport may bill you for Federal USF that was not previously charged and you will pay these charges.

-

Invoice Purchase Order Number – An optional PO number for tracking. This number is optional and appears on all invoices related to its market.

See the Customer Onboarding topic for finance forms that could be required for your business.

-

-

Select the check box to accept the terms of the Global Services Agreement.

-

Click Save.

After adding a company profile, you can view markets associated with it by choosing Company > Company Profile and clicking View Company Markets.

Accepted currencies

Accepted currencies vary for each billing market. In most markets, the US dollar (USD) is available as the secondary currency. For example, the Singapore billing market offers the option of billing in both Singapore dollars (SGD) and USD.

Note

Once you have chosen a currency, it cannot be changed.

| Billing Market | Local Currency Accepted | USD Accepted? | Other Currencies Accepted |

|---|---|---|---|

| Australia | AUD | ✓ | |

| Belgium | EUR | ✓ | |

| Bulgaria | BGN | ✓ | EUR |

| Canada | CAD | ✓ | |

| Denmark | EUR | ✓ | |

| Finland | EUR | ✓ | |

| France | EUR | ✓ | |

| Germany | EUR | ✓ | |

| Hong Kong | HKD | ✓ | SGD |

| Ireland | EUR | ✓ | |

| Italy | EUR | ✓ | |

| Japan | JPY | ✓ | |

| Luxembourg | EUR | ✓ | |

| Mexico | USD | ✓ | |

| Netherlands | EUR | ✓ | |

| New Zealand | NZD | ✓ | |

| Norway | EUR | ✓ | |

| Singapore | SGD | ✓ | |

| Spain | EUR | ✓ | |

| Sweden | SEK | ✓ | EUR |

| Switzerland | CHF | ✓ | EUR |

| UK | GBP | ✓ | EUR |

| USA | USD | ✓ |