Understanding Your Megaport Invoice

Megaport invoices for services every month. The invoice contains a summary of the services you ordered, general information about the invoice, the amount due, how to make a payment, and how to contact Megaport. These invoices and statements are sent monthly to the Billing Contact email address registered in your account. For more information on viewing current and previous invoices, see Downloading an Invoice.

Invoice details

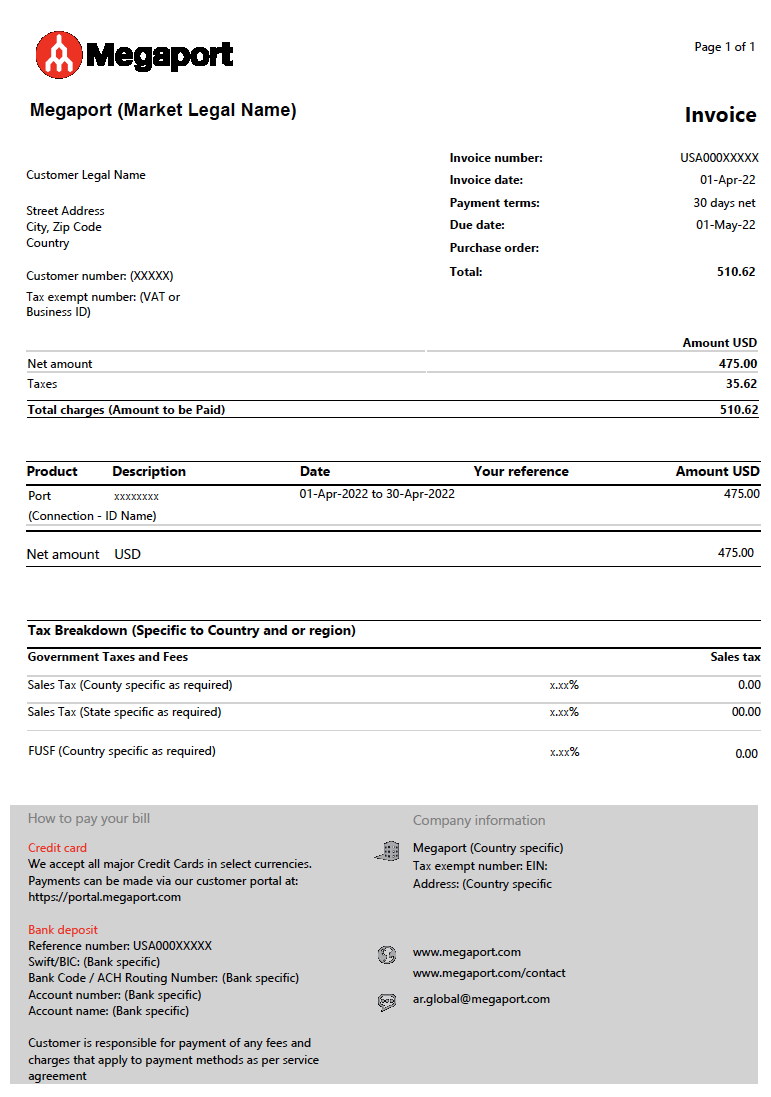

Megaport provides invoices in PDF and CSV file formats. The invoice includes billing activity details for that month. Here is a sample invoice in PDF format:

Your invoice header includes these terms:

- Invoice Number – The number assigned to your invoice.

- Invoice Date – The date the invoice was created.

- Payment Terms – The number of days that credit is allowed from the invoice date, as agreed between Megaport and your company. For more information on Port terms and pricing, see Port Pricing & Contract Terms.

- Due Date – The date when full payment is due for the invoice.

- Purchase Order – The purchase order you specified when you created the Megaport service. For the PO number to appear on the invoice, you must specify it in the Edit Market tab before the end of the billing period. For more information on how to update your Invoice Purchase Order Number, see Updating Your Billing Information.

- Total – Total including all taxes and surcharges.

The body of the invoice includes these terms:

- Description – The unique ID and name assigned to the service by Megaport and the service type. The Service ID is a unique 8-character alphanumeric reference associated with each service. For example,

hd72g38f. The ID also appears next to the service name on the Services page. - Date – The time period associated with the billed services.

- Your Reference – The service level reference number. This number appears only if you specified it when you ordered the service.

- Amount –- The sum of the billed service amount for time period within the date range.

You can view upcoming estimated bills for a specific service on the Billing page in the Portal. For more information, see VXC and IX Billing.

Every month, invoices and statements are sent to the Billing Contact email address you provided in the Megaport Portal in the Billing Markets > Edit Market tab. Invoices are usually sent on the first business day of the month, and statements around the 10th business day.

Megaport’s auto-pay system processes payments on the 20th of each month for all invoices listed on your account statement issued at the beginning of the same month. If you have any questions relating to Megaport’s auto-pay system, contact Megaport Accounts Receivable.

Important

Ensure that you keep the Billing Contact email address current so you receive invoices, statements, and other communication in a timely manner.

Taxes - domestic customers

Taxes are broken down by region, depending on where you ordered the Megaport service and the location of your registered business address.

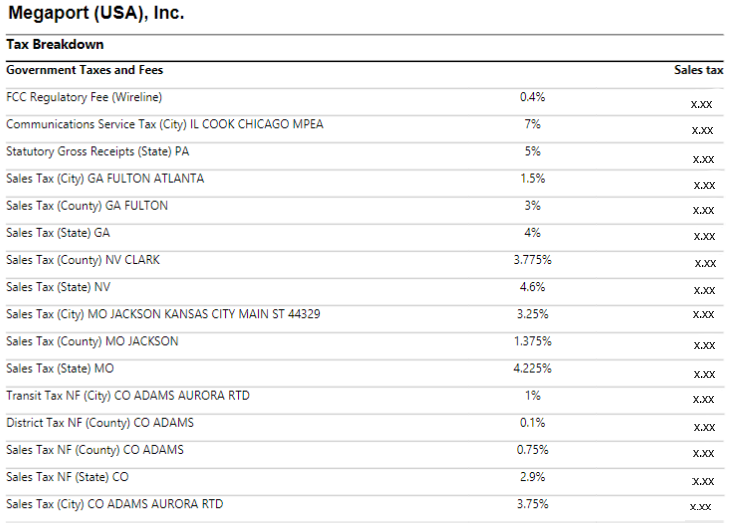

Here is an example of the tax breakdown on a USA invoice where a USA-based customer ordered services in several states:

The Federal Universal Service Fund (FUSF) rate in the USA is established by the Federal Communications Commission (FCC) and is updated on a quarterly basis. State sales tax rates in the US can also change occasionally, however less frequently than the FUSF.

The Carrier Cost Recovery is a surcharge to recover Property Tax and Franchise taxes that the company incurs.

If you qualify for any tax exemptions on any of your Megaport services, contact Megaport Accounts Receivable for instructions on how to upload your supporting documentation to our Exemption Certificate Management System.

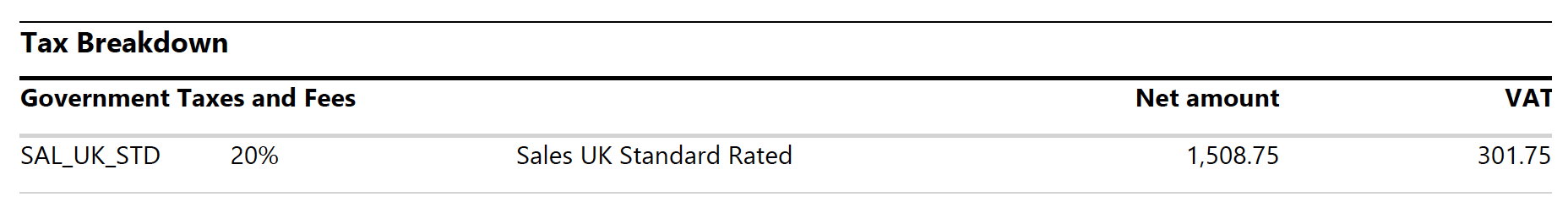

In European countries, the standard Value Added Tax (VAT) is generally applied on services to domestic customers. Here is a sample VAT breakdown for a UK domestic customer:

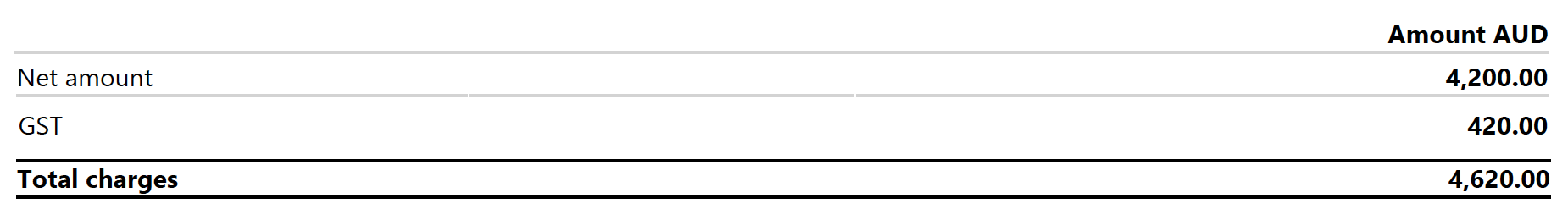

In the rest of the world, a local tax is applied for domestic customers. In this example, an Australian invoice includes a standard Goods and Services Tax (GST):

Taxes - non-domestic customers

In Europe, services for non-domestic customers within the European Union (EU) can be 0% rated for VAT purposes when the customer provides a valid EU VAT registration number. In this situation, the customer must account for VAT on a reverse charge basis.

Export customers are generally defined as those located outside the country from which Megaport provides and bills services. In the case of an EU billing entity, they are also located outside the EU. In all cases, an export customer does not have a permanent establishment for tax purposes or tax registration in the country of billing.

Export invoices are generally not subject to tax, such as VAT (Europe) or GST (AU, NZ, SGP).

Megaport Japan customers should note that the criteria for export transactions are more technical in Japan and depend on the nature of the services rather than where the customer is based.

Questions?

For billing or invoice questions, contact Megaport Accounts Receivable.